The projected increase suggests a growing number of consumers are likely facing difficult choices, potentially having to cut back on essential expenses to manage their budgets.

(Washington, D.C.) — The National Foundation for Credit Counseling (NFCC) released its latest Financial Stress Forecast, revealing a projected increase in financial stress for consumers in the coming months. This update follows the recent release of Q4 2024 data from The Federal Reserve Bank of New York’s Center for Microeconomic Data, which indicated a rise in both credit card debt and debt delinquency rates compared to the previous quarter.

The Fed’s report showed continued growth in household debt, further validating the trends indicated in the NFCC’s previous Financial Stress Forecast. Specifically, the Fed reported overall debt grew by $93 billion in Q4 2024, with about half of that increase related to credit card debt. Overall household debt levels now stand at a record $18.04 trillion. The report also revealed an increase in delinquencies. These figures underscore the growing financial pressures facing American consumers.

“The latest data from the Federal Reserve confirms what we’ve been seeing in our own data and what our Financial Stress Forecast has indicated,” said NFCC CEO Mike Croxson. “The rise in credit card debt and delinquencies in Q4 2024 is a clear indication that consumers are struggling to manage their finances, and this trend is reflected in our updated forecast.”

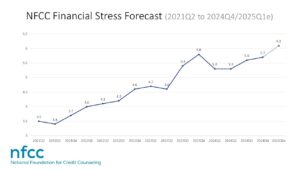

As of the fourth quarter of 2024, the NFCC Financial Stress Forecast stood at 5.7 , reflecting rising financial stress among U.S. consumers. This marks a steady increase from its 2021 low of 3.4 and signals a return to pre-pandemic levels. The forecast projects a further rise to 6.1 in the first quarter of 2025, suggesting mounting pressure on household finances. This upward trend reflects increasing financial pressures on households, which could lead to higher rates of delinquencies and charge-offs, posing challenges for lenders.

“Our data, combined with the Fed’s report, paints a concerning picture of the financial landscape for many Americans,” continued Croxson. “We are particularly concerned about rising credit card delinquency rates. The NFCC remains committed to providing resources and support to individuals navigating these difficult financial times. We urge anyone feeling overwhelmed by debt to reach out to an NFCC Certified Credit Counselor for assistance.”

The NFCC encourages consumers to take proactive steps to manage their debt, including budgeting, exploring debt management options, and seeking professional guidance. For more information about the NFCC’s Financial Stress Forecast, or to find a qualified credit counselor, please visit www.nfcc.org.

About NFCC

Founded in 1951, the National Foundation for Credit Counseling (NFCC) is the oldest nonprofit dedicated to improving people’s financial well-being. With a growing network of NFCC Certified Credit Counselors serving 50 states and all U.S. territories, NFCC nonprofit counselors are financial advocates, empowering millions of consumers to take charge of their finances through one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management. For expert guidance and advice, visit www.nfcc.org.

The NFCC Financial Stress Forecast serves as a critical early warning indicator of potential economic instability. As consumer financial health deteriorates, it can have far-reaching consequences for the broader economy, including increased loan defaults and economic slowdown. For more details, email press@nfcc.org.