If You Need Credit Card Relief, Know the Options and Risks

As the COVID-19 pandemic interrupts incomes and tightens family budgets, many Americans have been looking to credit card hardship programs as a potential source of relief. About 1 in 6 American cardholders (16%) tried to enter a hardship program in March and April 2020 alone, according to a new NerdWallet survey. In the same survey, more than three-quarters of American cardholders (77%) said their financial situation had been affected by COVID-19.

Credit card hardship programs provide assistance to cardholders in financial distress. Relief under hardship programs includes such things as deferring minimum payments or avoiding interest for a period of time. These programs can give people some much-needed breathing room — but they aren’t right for everyone, and getting into one does not mean their troubles are over.

Evaluate whether a hardship program is for you

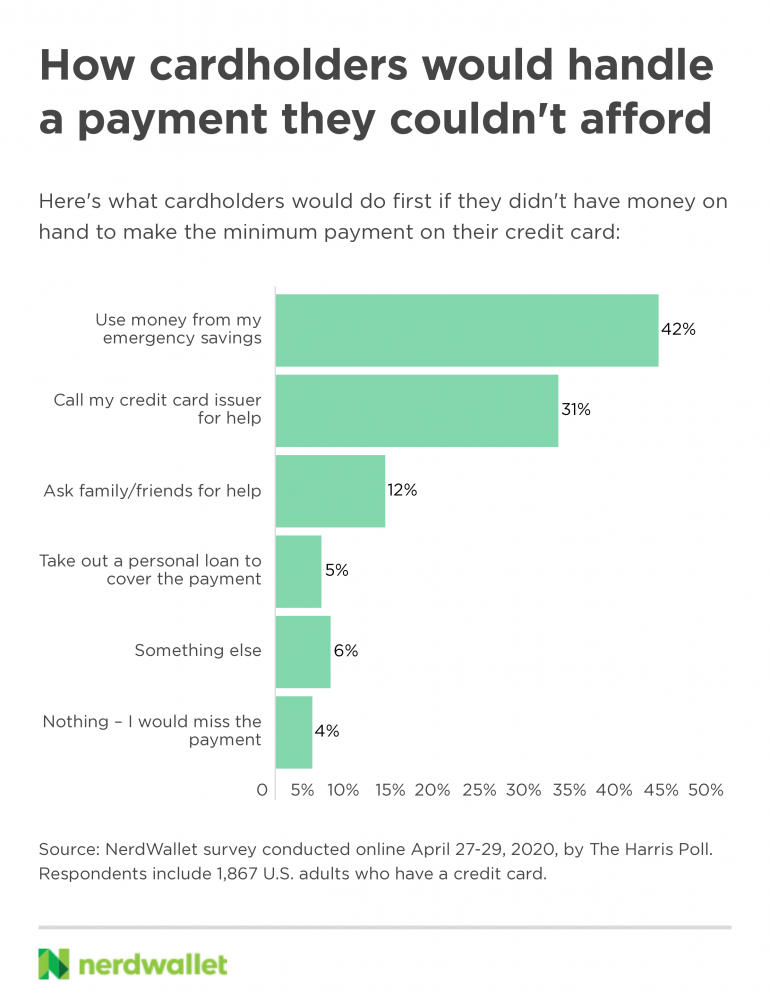

When asked what they would do first if they couldn’t cover the minimum payment on their credit card with cash they had immediately available, 42% of cardholders say they’d pull the necessary money out of emergency savings. About a third say they’d call their credit card issuer for help.

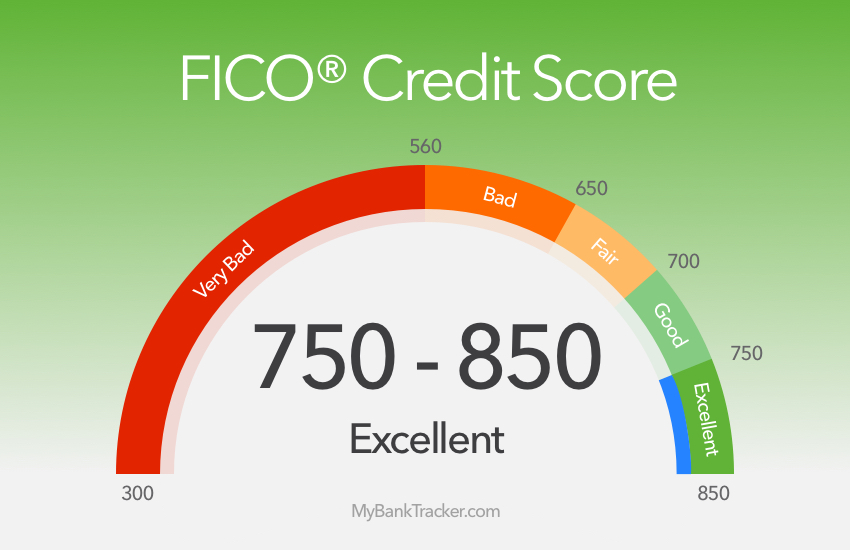

A credit card hardship program is an option for people who don’t have good alternatives — savings to tap, expenses they could trim from their budget, or family or friends who could lend money. It’s better than missing payments and potentially wrecking their credit. But individuals entering into a hardship program should be aware of the potential drawbacks.

Consider the downsides of enrolling

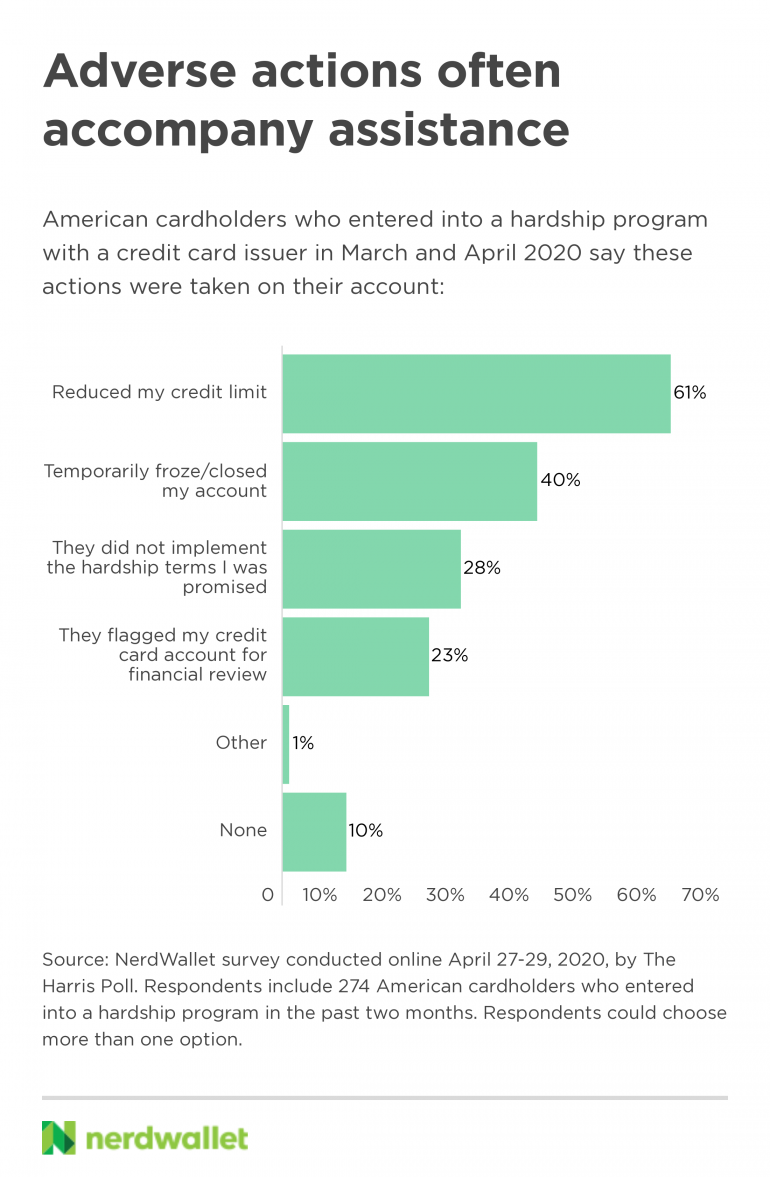

According to NerdWallet’s survey, of those American cardholders who say they were able to enter into a hardship program in March and April 2020 (13%), a whopping 90% report that adverse actions were taken on their accounts afterward.

If you go into a hardship program, do so knowing that your card’s credit limit could be lowered or your account could be temporarily frozen. If you decide that a program is the right choice for you, there are more steps you can take to protect your finances.

How to manage a hardship program

Follow the terms of the program strictly

According to U.S. cardholders who entered into a hardship program in March or April 2020, 77% were offered reduced, skipped or deferred minimum payment requirements, 49% were offered reduced or waived interest payments and 26% were offered waived late payment fees. Whatever agreement you reach, hold up your end of the deal. Failing to follow the terms can cause your assistance to be canceled.

Turn off automatic payments

If you have automatic payments set up from your checking account, manually delete them. Just because your card issuer says you can defer minimum payments for three months doesn’t mean it will cancel any already scheduled payments.

Check your credit report to make sure there’s been no negative reporting

The Coronavirus Aid, Relief, and Economic Security Act dictates that if your account was current (meaning you weren’t behind on payments) before the pandemic and you comply with the terms of a hardship agreement, your account will continue to be reported as current to the credit bureaus.

Check your credit reports using AnnualCreditReport.com starting around 30 days after you’ve worked out the agreement to make sure there’s been no negative reporting. Reach out to your issuer immediately if there are any negative marks so they can be corrected. Because of the coronavirus pandemic, you’re entitled to free credit reports from the site weekly — as opposed to annually — through April 2021, so be sure to monitor your reports regularly.

Seek longer-term assistance if you need it

Credit card hardship programs are short-term measures, and the assistance you get depends on your card issuer’s policies. If a few months of relief isn’t enough, look at longer-term options — such as nonprofit credit counseling — sooner rather than later.

A credit counselor can help you decide if you can get rid of consumer debt with general budgeting or a debt management plan, or if it makes sense to file for bankruptcy. Everyone’s financial situation is different, and a credit counselor from a nonprofit agency can help you figure out the next steps that are best for you and your circumstances.

Make a plan for when your financial situation stabilizes

This is a challenging time for millions of Americans, and it may be overwhelming to consider what’s next. But it’s important to have a plan for how you’ll deal with your finances once things stabilize to avoid hardship programs in the future.

One of the best ways to protect yourself in case of future hardship is having some savings to fall back on. When you’re back on your feet, it’s tempting to devote every spare cent to wiping out any remaining high-interest debt as quickly as possible. But a wiser course may be to make minimum payments on your credit card until you can build up a small emergency fund.

Personal finance experts often recommend an emergency fund with enough money to cover three to six months’ worth of expenses. For many households, however, building such a reserve could take years even in the best of times. So set a lower goal to start — something like $500 or $1,000. That’s not enough to carry you through a prolonged loss of income, but it can help you weather an emergency without having to rack up credit card debt.

Once you’ve put away some money for emergencies, start attacking your high-interest debt in earnest, while still trying to add to your savings. You’d probably save more in interest by putting everything toward debt payoff, but having some savings can give you peace of mind in an uncertain world.

The article If You Need Credit Card Relief, Know the Options and Risks originally appeared on NerdWallet.