DMP Calculator

What is a

Debt Management Plan?

A Debt Management Plan (DMP) is not a loan. It’s a tool offered by NFCC Member Agencies to get you back on the road to a financially stable, debt-free future. A dedicated NFCC-certified, nonprofit credit counselor can also help you determine if entering into a Debt Management Plan is the best option for you, and if not, lay out all your available options.

Do You Qualify for a

Debt Management Plan?

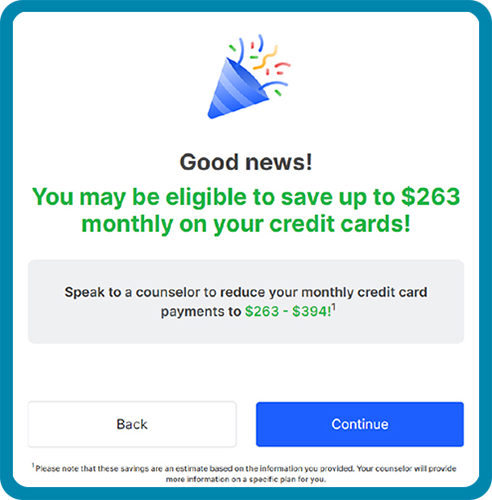

As you prepare to talk to a credit counselor, use our DMP Calculator to better understand how a nonprofit credit counselor can put you on a path to paying down your debt. Outcomes will vary based on what you owe and creditor terms, and our counselors can help you understand how best to move forward.

Use our digital entry tool below to get started.

How It Works

Sometimes all it takes is having someone walk through your situation with you and show you where to cut costs, help create a budget and bring hope with a plan for a better financial future. A Debt Management Plan is a unique agreement that helps you pay down debt and better manage your other expenses.

Counselor Guided

NFCC-certified counselors will help you assess your finances and determine the best course of action for your situation.

Monthly Payment

A DMP is a voluntary agreement to a monthly payment schedule where the interest rate on your debt is reduced.

The Pressure Is Off

The collection calls will stop and your budget will have breathing room to better manage other monthly expenses.

Connect with a Counselor to learn how a Debt Management Plan may help you.

NFCC Locator Form DigitalEntry

"*" indicates required fields

Positive Credit Score Impact

Participating in a Debt Management Plan can minimize any negative impact on your credit score. It will be noted on your credit report that you’re participating in a DMP, and in fact, can have a positive impact on your credit score. Timely payment history, which accounts for 35% of a FICO credit score, will positively impact the score, along with the decline in the amount you owe, which makes up 30% of the score.

Bye-Bye Collection Calls

Because you are involved in a Debt Management Plan, there won’t be inquiries for new credit, which is 10% of the score. When you work with an NFCC Member Agency on a Debt Management Program, you may benefit from reduced or waived finance charges or fees, fewer collection calls, and your accounts will be credited with 100 percent of the amount you send in.

About the NFCC

Founded in 1951, the National Foundation for Credit Counseling is the oldest nonprofit financial counseling organization with a mission to help all Americans gain control over their finances. We support a network of committed member agencies to deliver high quality, practical financial education and counseling services. Our 1,500+ NFCC certified credit counselors serve 50 states and all U.S. territories, empowering millions of consumers to take charge of their finances. Our NFCC certified credit counselors offer one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management.