What You Need to Know About Bankruptcy Credit Counseling and When to Consider It

If you are considering filing for bankruptcy, you need to know about an important requirement: credit counseling. It may not be the first thing that comes to mind when you think about bankruptcy, but it is an important step in the process. In this post, we will take a closer look at the requirement, how to satisfy it, and other considerations to keep in mind.

Background

By law, you must complete “pre-bankruptcy credit counseling” before filing for Chapter 7 or Chapter 13 bankruptcy as an individual. The government maintains a list of approved pre-bankruptcy credit counseling providers (filers in Alabama and North Carolina can find approved providers here). Most NFCC-certified agencies provide this service, and the NFCC can match you with an approved bankruptcy counselor when you fill out this form.

Upon completion of the counseling, you will be issued a certificate, demonstrating that you met the requirement. The certificate is valid for 180 days, meaning that you will have up to 180 days to file for bankruptcy. Wait longer than that and you will have to retake the pre-filing counseling.

In addition to pre-bankruptcy credit counseling, there is a second “counseling” requirement. After you file for bankruptcy, but before your debt(s) is discharged, you are required by law to complete pre-discharge debtor education. Most agencies that offer the credit counseling service offer debtor education, too. This article focuses on the pre-filing credit counseling, but you should keep in mind that there are two counseling/education requirements.

What is Involved?

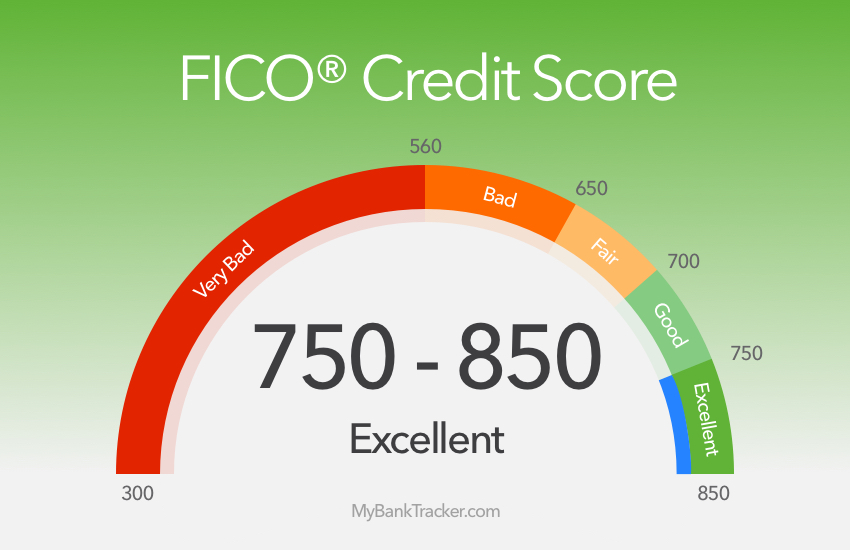

The purpose of the pre-filing credit counseling requirement is to ensure that consumers only file for bankruptcy if necessary. Other options may be available. Making significant changes to your household budget or enrolling in a debt management plan to pay off credit card debt, are two potential options that could allow you to bypass bankruptcy altogether. While bankruptcy may be the best option in some cases, it has drawbacks. These drawbacks include damage to your credit score, a bankruptcy notation on your credit report for 10 years, and attorney’s fees and court costs. This whitepaper discusses some of the pros and cons of bankruptcy compared to other debt relief methods.

So, what happens in an actual counseling session? The counselor will work with you to prepare an estimated budget based on your income. The counselor will assess whether a repayment plan other than bankruptcy seems feasible, and if it does then the counselor will provide a plan. There is no requirement that the you accept the plan, but this exercise can be very helpful. If the session reveals an alternative to bankruptcy, you may decide to pursue that option instead. Counselors should explain the alternatives to bankruptcy fully, and explain the pros and cons of each option. Counselors may also be able to connect you to local resources that could help further.

Choosing a Counselor

You may decide to choose your own bankruptcy credit counseling agency (we included links at the top of this post for doing just that). However, many people seek the advice of a bankruptcy attorney and then use the counseling service recommended by that attorney. There is nothing wrong with this approach, but there are a few things to keep in mind.

Perhaps the most important thing to consider is this: how committed are you to filing for bankruptcy instead of pursuing a different option? You may be interested in bankruptcy simply because you are facing significant debt. Most people have heard of bankruptcy and know that it can discharge some obligations. But you may not be familiar with other repayment options. On the other hand, you may already be certain that bankruptcy is the right choice for you.

If you go to a bankruptcy attorney after being 100 percent sure that you want to file for bankruptcy, then the pre-filing counseling may be just a formality. On the other hand, if you are focused on solving a debt problem in a general sense, you will care much more about the quality of your pre-filing counseling session because you will want to learn about additional options that may be available. Therefore, if there is any doubt in your mind about bankruptcy, you should take some time to pick the counseling agency that is right for you and will provide a personalized approach to the counseling session. We recommend NFCC member agencies for this purpose.

Key Points to Remember

Pre-filing credit counseling is a requirement for individuals who file for Chapter 7 or Chapter 13 bankruptcy. You may pick your own agency or use a referral from your bankruptcy attorney. We recommend working with an NFCC-member agency, and encourage you to consider alternatives to bankruptcy when feasible. Your counselor should review these alternatives with you. Lastly, remember that a counseling certificate is valid for 180 days, so you will need to file within that time-frame after the counseling session. Have more questions? See our Bankruptcy FAQ.