What’s a Good Credit Score?

Q. What’s a good credit score?

Dear reader,

A “good” score is generally considered to be around 700 or above in a score range of 300–850. However, this number is more of a loose guideline than an actual rule. As you have probably noticed, depending on the credit bureau you consult, the website you use to view your score, or the lender evaluating your creditworthiness, your score will vary and so will the definition of “good” credit.

The different credit scores are a product of the multiple credit scoring models currently used by lenders and websites in the financial sector to calculate your score. The most widely used scoring models are the FICO Score and the VantageScore. The FICO score is developed by the Fair Isaac Corporation, and it’s used by 90% of lenders in the industry. On the other hand, the VantageScore was developed by the three credit bureaus, Equifax, Experian, and TransUnion. The bureaus can provide you with both scores. Both scoring models consider similar factors in their calculations and their latest versions have a score ranging from 300–850.

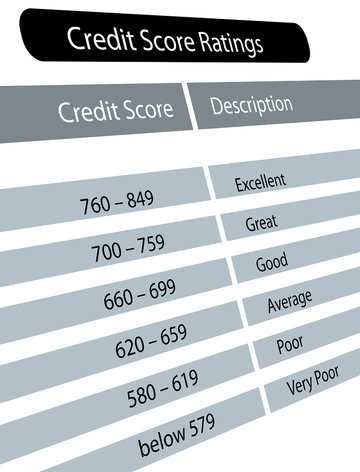

So, let’s take a look at what FICO and VantageScore consider “good” credit scores. According to FICO, a score ranging from 670–739 is considered to be “good.” The scores can range from very poor to exceptional, a category reserved for scores above 800. The detailed FICO breakdown is as follows: 800–900 exceptional, 740–799 very good, 670–739 good, 580–669 fair, and 250–579 risky. Similarly, VantageScore scores range from very poor to excellent and consider “good” scores to fall in the 700–749 range.

According to FICO’s research, the consumer’s average FICO credit score has been steadily rising and reached 700 points for the first time in April 2017. s with scores in the 800-range raised a bit. This means that the economy’s upturn in the last couple of years and the growing financial credit education have helped the general population learn how to use and better take advantage of credit.

And as the general consumer strives to get “good” credit, you should review your score and know where you stand. It’s key to remember that each lender or credit card company will have different definitions of what “good” scores are when they issue credit and offer interest rates and overall repayment terms to consumers. So, what does “good” credit mean beyond a number? A “good” score will help consumers get more favorable repayment terms from lenders. This translates to better interest rates and possible lower monthly payments. Having “good” credit offers you more financial options at a lower cost. So, it’s crucial not only to have “good” credit but to maintain it. The best strategy to maintain a “good” credit score and increase it over time is to first and foremost, always pay your credit cards and loans on time. Then, focus on keeping your balances low in all of your credit lines. Strategically speaking, you should only use 30% of your available credit. And last, but not least, refrain from getting new credit often.

So, next time you ask yourself “what is good credit?” you will be better prepared to answer yourself depending on your credit needs. Instead, I encourage you to ask yourself a different question: Do I have my best score yet?

Sincerely,

Bruce McClary, Vice President of Communications

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.