Third-quarter NFCC data indicate that consumers who are struggling to manage all-time high levels of debt will continue to experience hardship.

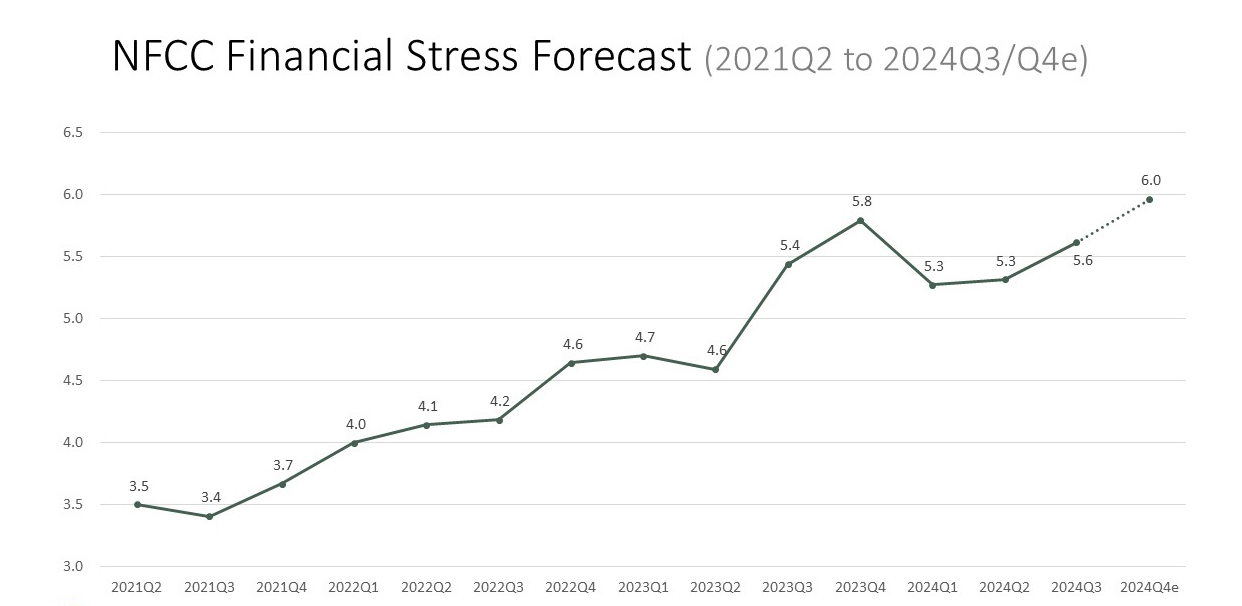

(Washington, D.C.) — The National Foundation for Credit Counseling (NFCC) today released its latest Financial Stress Forecast, revealing that a recent surge in consumer financial distress is likely to continue into 2025. The NFCC data support a recent report issued by The Federal Reserve Bank of New York’s Center for Microeconomic Data which shows that total household debt increased by $147 billion in Q3 2024, to $17.94 trillion. Credit card debt alone increased by $24 billion to $1.17 trillion.

“The Financial Stress Forecast, which is derived through proprietary data from individuals seeking credit counseling, is a strong indicator of financial stress levels within the population at large,” said NFCC CEO Mike Croxson. “With debt levels at record highs, we are not surprised to see that our Debt Burden Scale has consumers moving rapidly toward dangerous levels of financial strain.”

Measuring consumer financial health in stages, the Q3 NFCC Financial Stress Forecast reached 5.6, a 99.3% jump since its lowest of 3.9 set in 2021. Analysts project that by the end of the year, many more consumers will reach the Debt Burden Scale’s Stage 6, a “Tightening the Belt” stage in which consumers may cut back on food and personal savings to make ends meet.

“This is an alarming trend with millions of Americans unable to keep up with increasingly unmanageable debt,” said Croxson. “Nonprofit credit counseling can provide the support consumers need to navigate these challenges. We encourage anyone who is feeling overwhelmed by debt to seek help from our certified counselors now.”

About NFCC

Founded in 1951, the National Foundation for Credit Counseling (NFCC) is the oldest nonprofit dedicated to improving people’s financial well-being. With a growing network of NFCC Certified Credit Counselors serving 50 states and all U.S. territories, NFCC nonprofit counselors are financial advocates, empowering millions of consumers to take charge of their finances through one-on-one financial reviews that address credit card debt, student loans, housing decisions, and overall money management. For expert guidance and advice, visit www.nfcc.org.

The NFCC Financial Stress Forecast serves as a critical early warning indicator of potential economic instability. As consumer financial health deteriorates, it can have far-reaching consequences for the broader economy, including increased loan defaults and economic slowdown. For more details, email press@nfcc.org.