How can I improve my credit score?

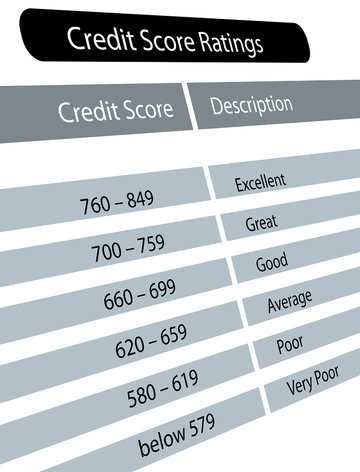

Q: I recently checked my credit score using an online service and discovered that my score is below 600. I believe my low scores are largely due to a few thousand dollars I have in collections with a handful of collection agencies from accounts I have accumulated over the past several years. I want to pay off debt and improve my credit score. What are some strategies I should consider?

Dear reader,

I applaud your initiative to tackle your outstanding debt in collections head on to boost your score. Implementing a strategy to meet your goal is the right starting point.

Let’s begin by talking about your score because all scores are not created equal. In fact, they are calculated using numerous models. The most commonly recognized scoring models are FICO and VantageScore, which was used to calculate the score you received from Credit Karma. I recommend you also get your FICO score, since it is very likely that many of your future lenders will use it to support their lending decision.

A good strategy to boost your score, regardless of the scoring model, can begin with the liquidation of your debts in collection, just as you are planning to do. Start by paying off the debt with the smallest balance first, then move on to the next debt. The goal is to have these debts show as “paid” on your report so that they have a less significant impact on your score. If you have larger debts, a quick way to pay them off is to settle your debts for less than what you owe, but beware that this will not likely benefit your credit score as much as paying it back in full. If you work directly with the collection agency, make sure you negotiate a favorable deal for you and ask for it in writing. Also, do not agree to make any payments through your bank account or prepaid card. Instead, make payments via money order, certified checks or even a wire transfer.

While you are repaying your debts in collection, you should be managing your credit strategically. What does this mean? It means that you should understand the factors that impact your score and adopt new financial habits that will positively influence your score on a daily basis. For example, you should make timely payments on other debts and credit cards to establish a consistent positive payment history that will definitely boost your score. You should keep your credit cards and debts balances low to maintain a low utilization ratio, which will also boost your score. Ideally, you should only use approximately 30% of your available credit or less. In addition, avoid too much shopping around for new credit throughout the year because multiple credit inquires in short amount of time will lower your score.

Now, if you want a professionally tailored strategy to boost your score, one of your best options is to work with a certified credit counselor from a nonprofit credit counseling agency. Your counselor will review your credit report and evaluate your current financial situation to help you identify the best range of options and strategies to repay your debts while optimizing your budget and helping you stay on track.

Even if you follow your counselors plan, it’s impossible to pin down a specific increase in the score. The formulas to calculate the scores are kept confidential, but we do know what are the factors used for the calculation. So, if you manipulate these factors, you can predict to see an increase on your score. I also want to caution you about the short-term effects of debt repayment on your score because they may not be as high as you may expect. The VantageScore and the newest FICO scoring model (FICO 9) omit paid debt collection accounts with zero balances when calculating your score. So, if you paid them off, they won’t count against you anymore, which will boost your score. Unfortunately for most consumers, many lenders still use the previous FICO scoring model, FICO 8, which factors in debts, even if they are paid off. If your score is calculated using this model, you can expect to see a less significant effect on your score, especially when you pay older debts.

While no one can realistically provide a guarantee based on a specific credit score, following the right debt repayment strategy and incorporating healthy financial habits in your life can offer the best possibility for reaching your goal. Increasing your credit score will take some time, so patience and commitment will help see you through to the results you hope to achieve.

Sincerely,

Barry Coleman, Vice President of Counseling & Education Programs

Barry Coleman has over 16 years’ experience in the credit counseling industry previously holding several management positions in training, regulatory compliance, and financial counseling. Barry holds a Bachelor of Arts Degree in Organizational Management from Ashford University and a Master’s of Business Administration Degree from Ohio University. In addition, Barry served over 32 years in the United States Air Force and the Air National Guard, retiring in 2010 as the State Command Chief Master Sergeant of the Virginia Air National Guard.

If you have a question about your own specific financial situation, don’t hesitate to submit your question to our experts today! If you would like a thorough review of your personal financial situation, contact one of our nonprofit credit counseling agencies today!

*Some questions have been shortened and/or altered for publication purposes while others have been published as is