Client Impact & Research

Personal Empowerment

From measurable results to personal stories, here’s a peek at how the NFCC is making a very real impact on people’s lives.

The National Foundation for Credit Counseling and its members are committed to empowering people to take charge of their finances and futures. We research and measure the impact of nonprofit financial counseling and education over time, and keep a pulse on changing consumer financial literacy needs and personal finance challenges.

Sharpen Clients Achieved

-

$17K

Average decrease in total debt -

$8k

Average decrease in total debt -

50-point

Average* increase in their credit score from baseline.

*Average bottom 25th percentile of clients from a 9,000 Sharpen clients data sample.

Client Research

NFCC’s 2021 Consumer Financial Literacy and Preparedness Survey

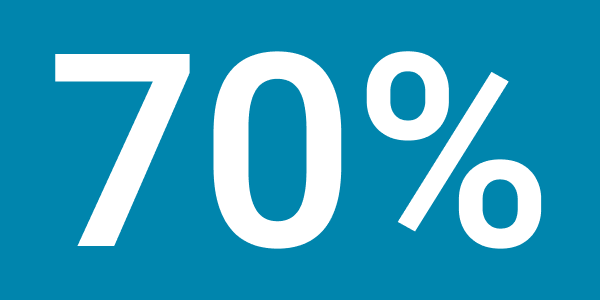

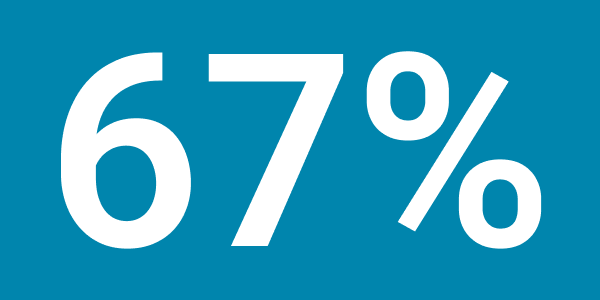

Every year the NFCC provides a fresh look at the latest consumer financial health trends and statistics with our annual Consumer Financial Literacy Survey. This year we’ve combined both the Consumer Financial Literacy Survey and our annual Military Financial Readiness Survey to look at the financial health of both the general population and Active Duty Military, Veterans and their Spouses. The survey tracks key data points that show trends associated with personal finance challenges and priorities including retirement, savings, credit card debt, student loan debt and more.

Financial Impact of the COVID-19 Pandemic on American Adults

On March 11, the World Health Organization characterized COVID-19 as a pandemic. This declaration sent shockwaves through the nation and the financial lives of many around the country due to shutdowns, layoffs and much uncertainty. This year’s annual financial literacy survey was fielded amidst that announcement. To gather an understanding of the immediate financial impact of the pandemic and the resources Americans need most, NFCC and BAI worked together quickly to get another survey out, the Financial Impact of COVID-19 Survey, conducted by The Harris Poll in May among over 2,000 U.S. adults.

2020 Active Duty Military, Veterans and Spouses Financial Readiness Survey

The 2020 Military Financial Readiness Survey, sponsored by Wells Fargo, examines a range of topics and reveals unique insights about the similarities and differences between active duty service members, spouses/partners of active duty service members, and veterans.

Envisioning Home Ownership (EHO) Project Study

NFCC’s Sharpen Your Financial Focus results showed that counseled clients have stronger financial positions and newfound confidence. The Envisioning Homeownership Program builds on these successes by helping clients attain affordable and sustainable homeownership with the continued assistance of an NFCC Certified Financial Counselor.